GameStop 2.0? Why Robinhood’s CEO Claims Tokenization Is the Only Fix for Trading Halts

The future of the equity market infrastructure has once again been debated by Robinhood CEO Vlad Tenev, who believes that tokenized stocks are the best way to avoid trading halts such as those experienced during the GameStop frenzy in 2021.

In a post on X, Tenev referred to the incident as one of the most apparent failures of modern equity markets, but not due to misconduct by the broker and instead due to the old settlement mechanics, which could not survive extreme volatility.

Five years prior, Robinhood and several other brokerages had to limit purchases in a limited list of the most actively traded meme stocks, most notably GameStop.

The action went off a market backlash by retail investors who felt sidelined in the market at a pivotal time.

Tokenized Stocks Could Replace a Broken Settlement System, Tenev Says

Tenev attributed the pause to clearinghouse risk-management regulations that were related to the two-day settlement cycle of U.S. equities, which was then considered as the standard.

Since trades were not settled on the spot, brokers had to leave a huge amount of collateral to handle counterparty risk.

As the trading volumes and price movements increased exponentially, those deposit demands jumped icily, and firms could do little but restrict the activity.

Robinhood has since advocated more rapid settlement, which also helped to effect the industry-wide T+2 to T+1 settlement in the United States.

Although the change alleviated some of the pressure, Tenev indicated that the fundamental issue was not resolved.

Practically, a T+1 system may nonetheless extend into days around weekends and holidays, leaving markets vulnerable to the fast-flowing news and social-media-based trading.

It is against this background that Tenev remarked that tokenization is a type of structural substitute and not a peripheral solution. Tokenization involves issuing stocks as blockchain-based tokens that settle in near real time.

With atomic or instant settlement, trades no longer carry multi-day counterparty risk, reducing the need for clearinghouses to demand large collateral buffers and lowering the likelihood of sudden trading restrictions.

Tenev also pointed to additional features such as continuous, 24-hour trading, native fractional ownership, and a transparent ledger of ownership as potential advantages.

Robinhood Bets on Tokenized Stocks as Regulators Clarify Rules

Robinhood has already tested this model outside the U.S. In Europe, the company offers more than 2,000 tokens representing U.S.-listed stocks and exchange-traded funds, giving investors exposure to price movements and dividends.

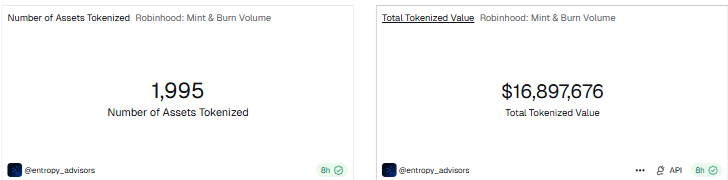

On-chain data cited by tokenization trackers shows that Robinhood has minted nearly 2,000 such stock tokens worth just under $17 million, a relatively small figure compared with other tokenization platforms whose offerings exceed $500 million.

In the coming months, Robinhood has stated that it will continue to build these products, including around-the-clock trading and decentralized finance, including self-custody and lending.

The shift comes as tokenization in traditional finance gains momentum, with the New York Stock Exchange in January preparing to construct a digital platform to trade and on-chain settle tokenized securities, subject to regulatory approval.

Nasdaq has also prioritized tokenized equities; it has submitted a rule change application whereby on-chain representations of listed stocks can be traded according to existing market structure rules.

On their part, regulators have emphasized that tokenization has no impact on the legal status of a security.

The SEC once again confirmed that tokenized securities are subject to the federal securities laws, whether stored on a blockchain or a conventional ledger.

Pivotal December was followed by the SEC announcing a rare no-action letter against the Depository Trust Company, creating a pilot to tokenize 2026 U.S. Treasuries, significant ETFs, and Russell 1000 stocks.

- XRP Price Prediction: XRP Is Crashing Fast – Is This the Beginning of a Total Breakdown to Zero?

- XRP Price Prediction: XRP Ledger Smashes Past $2 Billion in Tokenized Assets – Why This Could Send XRP Parabolic

- We Hacked China’s Alibaba AI to Predict the Price of XRP, Bitcoin and Ethereum By the End of 2026

- Shiba Inu Price Prediction: Over 250 Billion SHIB Withdrawn – Are We Hours Away From a Surprise Rally?

- Dalio: U.S. Nears Crisis Point as Bitcoin Trapped by American Selling Pressure

- XRP Price Prediction: XRP Is Crashing Fast – Is This the Beginning of a Total Breakdown to Zero?

- XRP Price Prediction: XRP Ledger Smashes Past $2 Billion in Tokenized Assets – Why This Could Send XRP Parabolic

- We Hacked China’s Alibaba AI to Predict the Price of XRP, Bitcoin and Ethereum By the End of 2026

- Shiba Inu Price Prediction: Over 250 Billion SHIB Withdrawn – Are We Hours Away From a Surprise Rally?

- Dalio: U.S. Nears Crisis Point as Bitcoin Trapped by American Selling Pressure