Over $520M in Longs Liquidated as Bitcoin Price Drops Below $68,000

Jai serves as the Asia Desk Editor for Cryptonews.com, where he leads a diverse team of international reporters. Jai has over five years of experience covering the web3 industry.

- [LIVE] Crypto News Today: Latest Updates for Dec. 22, 2025 – Sector Rotation Pushes NFTs Higher; RWA and DeFi Extend Gains

- [LIVE] Crypto Market Update: Bank of Japan Raises Rates by 25 bps; Crypto Markets Extend Slide as BTC Breaks Below $86K

- [LIVE] Crypto Market Update: Market Pullback Deepens: ETH Near $2.8K as Sector Indices Flash Steep Declines

- [LIVE] Crypto Market Update: 10x Research Flags Cracks in 2026 Bullish Narrative as Bitcoin Reclaims $87K Amid Extreme Fear

- [LIVE] Crypto News Today: Latest Updates for Dec. 16, 2025 – Bitcoin Drops Under $86,000 as Extreme Fear Deepens Crypto Market Rout

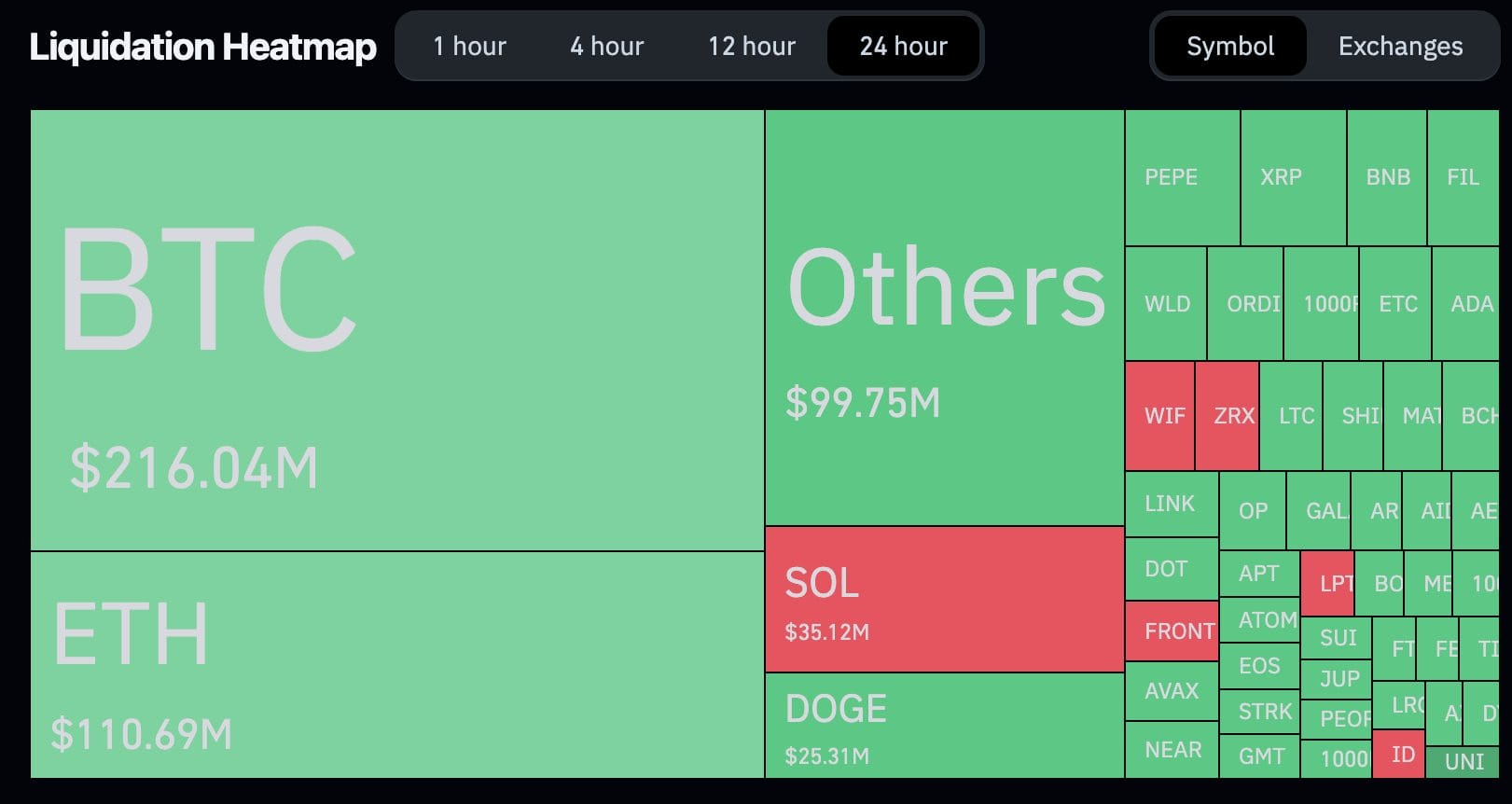

The price of the leading cryptocurrency Bitcoin faced a deep correction from its all-time highs during early Asian hours on Friday. Bitcoin is trading below $68,000, nearly 7.5% down in the last 24 hours. The price correction triggered massive liquidations as the entire network saw over $657 million positions liquidated in the last 24 hrs.

As per Coinglass data, over $522 million in longs and $137 million in short positions have been liquidated in the last 24 hrs. Out of which $216 million in BTC longs were liquidated. Most liquidations happened on Binance and OKX with $248 million and $236 million, respectively.

The second-largest cryptocurrency in market cap Ethereum also dropped below $4,000 today. Currently trading at $3,700, ETH is down nearly 7.3% in the last 24 hrs.

Bitcoin Spot ETFs Record $132M in Net Inflow

The total net inflow of Bitcoin spot ETFs on March 14 was $132 million. Grayscale ETF GBTC had a single-day net outflow of $257 million. The Bitcoin spot ETF with the largest single-day net inflow on the day was the BlackRock ETF IBIT, with a net inflow of $345 million, as per SoSoValue data.

The current total historical net inflow of IBIT has reached $12.37 billion. Followed by VanEck ETF HODL, the single-day net inflow is approximately $137 million, and the current total historical net inflow of HODL is at $364 million. As of press time, the total net asset value of Bitcoin spot ETFs is $57.86 billion, the ETF net asset ratio (market value as a proportion of the total market value of Bitcoin) reached 4.16%, and the historical cumulative net inflow has reached $11.96 billion.

On March 12, spot Bitcoin ETFs recorded a staggering $1.05 billion in net inflows, highest single-day net inflow since the launch date.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and DOGE By the End of 2025

- Bitcoin Price Prediction: Fundstrat Tells Clients to Brace for a $60K Bitcoin Correction Next Year

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- China’s DeepSeek AI Predicts the Price of XRP, BTC, and DOGE By the End of 2025

- Bitcoin Price Prediction: Fundstrat Tells Clients to Brace for a $60K Bitcoin Correction Next Year

- Bitcoin Price Prediction: Why $88,000 Could Be the Calm Before a $94,000 Push

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto