Moscow Releases Tax Calculator for Russian Crypto Miners

The Russian tax agency, the Federal Tax Service (FTS), has unveiled a tax calculator tool for crypto miners operating in the nation.

Per a report from the Russian state-run news agency TASS, the FTS has also “posted information” on crypto “exchange” rates for taxpayers.

Russian Crypto Miners: Ready to Pay Taxes?

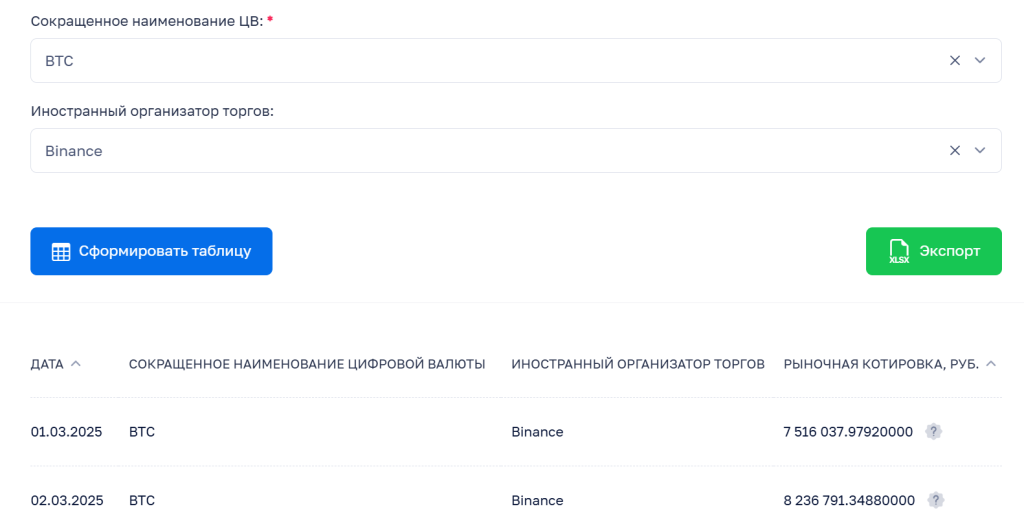

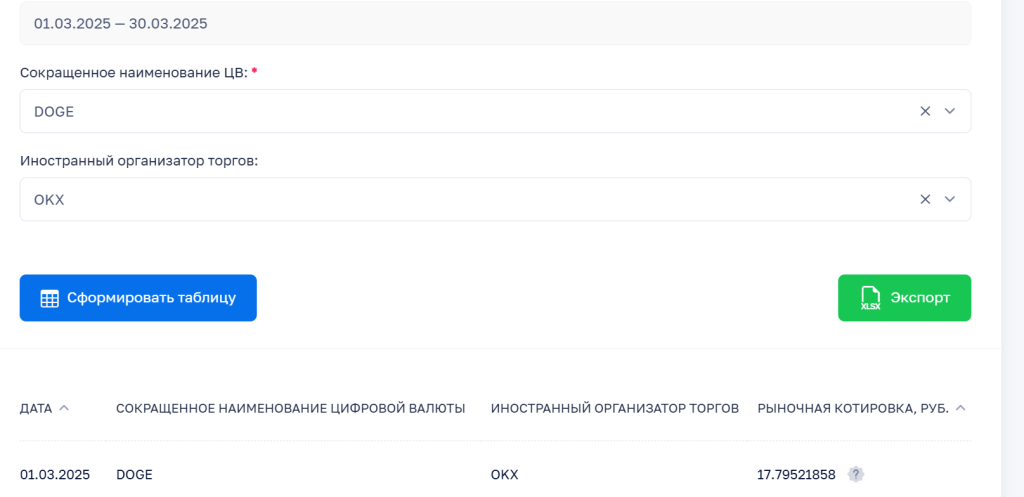

The FTS tool lets miners check on the exact “minimum closing price” in fiat rubles of popular coins on “foreign trading [platforms]” (crypto exchanges) on specific dates in the period January 1, 2025, to March 31.

Quoting the FTS’ press service, TASS reported that the agency’s website “has published information on market quotes for digital currencies and total volumes of daily trades with foreign trade organizers for taxpayers.”

This, the FTS said, will help “taxpayers” to “determine income from digital currency transactions based on information from open sources.”

“This will help taxpayers calculate the tax base for digital currency transactions on each individual date of income recognition.”

Russian Federal Tax Service

The FTS noted that “digital currency obtained as a result of mining” is considered as a taxable form of income.

And it wrote that “the value of digital currency is determined based on market prices on the date of the actual receipt of income.”

The FTS clarified that cryptoassets become income on “the day when the person who acquired them has the right to sell them.”

‘Framework’ in Place

The tool, however, appears to be somewhat imperfect. At the time of writing, it only carries data from seven crypto exchanges, including Binance, ByBit, KuCoin, and MEXC.

And while it collates data on a wide range of popular coins, including Bitcoin (BTC) and Dogecoin (DOGE), some high-cap coins like Ethereum (ETH) and XRP appear to be missing from its database.

The FTS has also added disclaimers to its new resource, noting that the information it provides “is subject to independent verification by the taxpayer.”

Russia has already “legalized” crypto mining. And in November 2024, President Vladimir Putin signed a law stipulating the creation of a “framework” for taxing crypto miners.

However, the FTS and lawmakers are still yet to finalize the finer details of the laws governing taxes for miners.

The November law stipulates that crypto-related trades are subject to a two-tiered level of income tax.

Those with earnings of up to 2.4 million rubles ($28,000) must pay levies of 13% on their earnings.

Anyone earning more than this will be obliged to pay 15%, with corporations ordered to pay the regular corporate tax rate (25%) on their earnings.

Tax Agency’s Register

All miners using over 6,000kWh of electricity per month to power their rigs must sign up to an FTS-curated register.

Non-compliance is punishable by a system of fines, with miners who fail to register set to pay 40,000 ruble ($466) fines.

Those operating under the threshold do not have to declare their operations, however. It is not entirely clear yet if Moscow will ask sub-threshold users to declare their coin holdings or pay taxes on them.

Russian Crypto Miners: Tax Windfall Incoming?

The Russian crypto mining industry has previously assured Moscow that the Treasury can expect to make over half a billion USD per year from taxing miners.

The FTS’ new web resources also contain instructions for what it calls “mining infrastructure operators.”

It defines these as individuals or companies who “provide services for the provision of mining infrastructure for the activities of miners and mining pools.”

Russian crypto experts have previously claimed that nine out of 10 mining firms focus their efforts on BTC (although some data compilers dispute this claim).

However, Russian crypto enthusiasts have previously told Cryptonews.com that many home-based miners prefer to mine ETH.

All experts also agree that Litecoin (LTC) – which is included in the FTS’ database – also enjoys a minority interest among major domestic mining players.

- Elon’s Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- Bitcoin Price Prediction: $1.55 Billion Flooded In Last Week – Are Investors Preparing for a Global Meltdown?

- China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- XRP Price Prediction: Ripple Is Now Aligned With U.S. Lawmakers – Is This the Moment XRP Becomes Unstoppable?

- Elon’s Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- Bitcoin Price Prediction: $1.55 Billion Flooded In Last Week – Are Investors Preparing for a Global Meltdown?

- China’s Alibaba AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- XRP Price Prediction: Ripple Is Now Aligned With U.S. Lawmakers – Is This the Moment XRP Becomes Unstoppable?