MicroStrategy’s Michael Saylor to Sell $216 Million Company Shares for Bitcoin

Hongji is a reporter who covers crypto, finance, and tech. He graduated from Northwestern University's Medill School of Journalism with a Bachelor's and a Master's. He has previously interned at HTX,...

- Altcoin Season Shows Flickers As Bitcoin Tests Support Near $90,000

- Why Traders Now Treat Crypto Prediction Markets Like Real-Time Shadow Polls

- Ethereum Rises As Altcoin Season Fear Eases And Select Tokens Join The Move

- The Unbanked Billion: Why AGI Will Choose Bitcoin Over Dollars

- Bitcoin Stalls Near $90K as Select Altcoins Rally, Leaving ‘Altcoin Season’ on Hold

MicroStrategy co-founder Michael Saylor has planned to sell company shares worth $216 million for personal Bitcoin investment.

According to a recent filing with the U.S. Securities and Exchange Commission, Saylor will be selling 310,000 stock option awards, originally granted in 2014. MicroStrategy closed at $685.15 on Jan. 2, making Saylor’s holding worth $216 million.

Saylor revealed in MicroStrategy’s 2023 third-quarter earnings call, and as first disclosed in the company’s 10-Q filing, his intention to sell up to 5,000 shares per trading day within a four-month window.

This selling strategy, bound by a minimum price condition, allows Saylor to divest up to 400,000 shares of his vested options. The stock option awards, which are set to expire on April 26, 2024, form a key part of Saylor’s planned transaction.

“I was granted a stock option in 2014 with respect to 400,000 shares, which is going to expire next April,” said Saylor in the call. “Exercising this option will allow me to address personal obligations as well as acquire additional Bitcoin to my personal account.”

“I continue to be optimistic about MicroStrategy’s prospects and should note that my equity stake in the company after these sales will remain very significant,” said Saylor.

MicroStrategy’s Holding Exceeds $8 Billion

From Nov. 30 to Dec. 26, MicroStrategy purchased 14,620 Bitcoins for $616 million, increasing their total holdings to 189,150 Bitcoins worth over $8 billion. The company’s total holding represented a significant 1% of all Bitcoins currently in circulation post purchase, keeping its place as the largest listed corporate holder of Bitcoin among public companies.

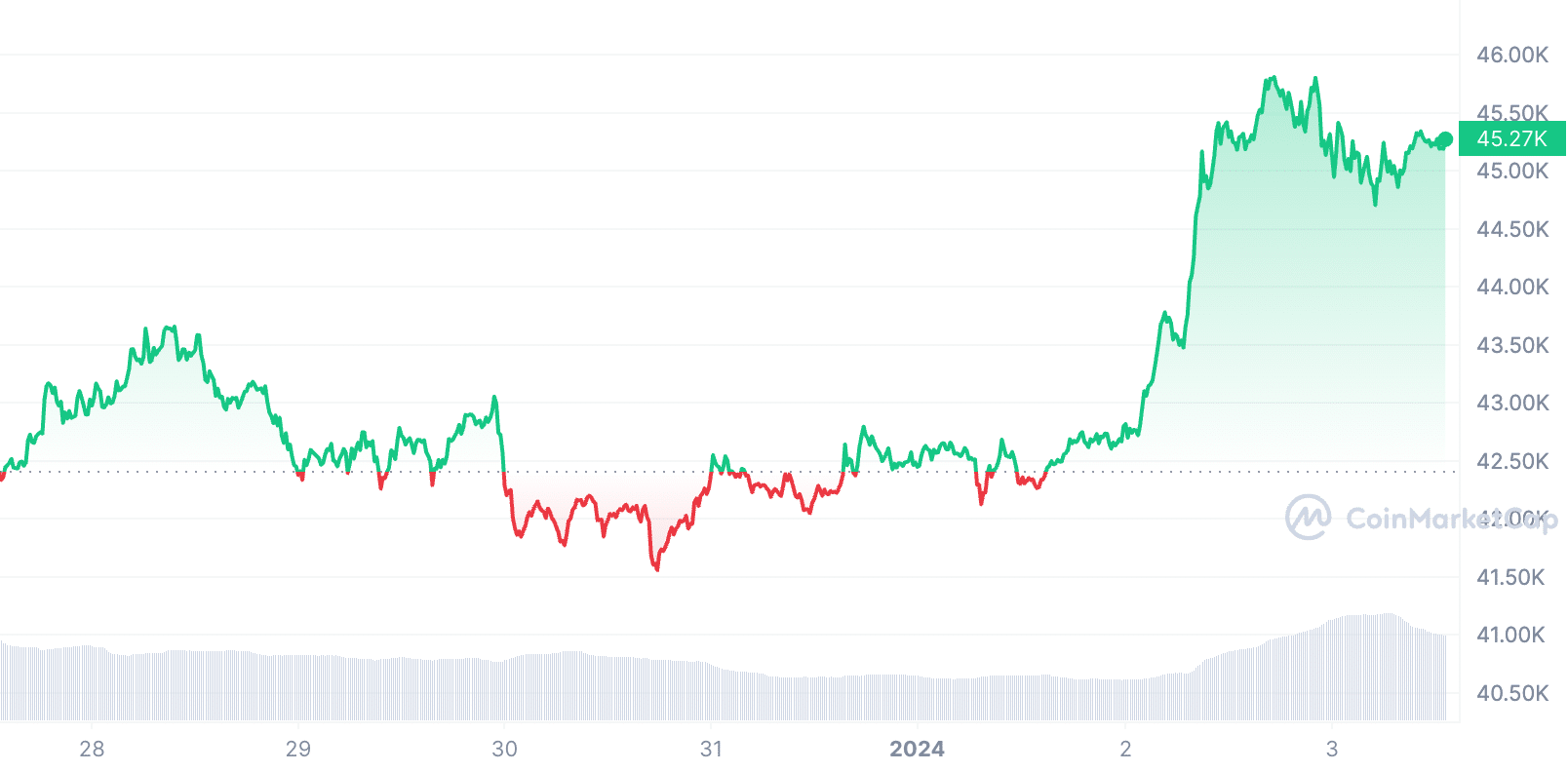

Bitcoin Price Soars to $45,000 with Record-High Daily Transactions

Starting the new year strong, Bitcoin’s price has exceeded $45,000. Pending the SEC’s decision on the spot Bitcoin exchange-traded funds (ETFs), it is trading at $45,272 at the time of writing, up by 6.87% over the past week according to CoinMarketCap.

In addition, Bitcoin has achieved a significant milestone on New Year’s Eve, setting a new record in its network’s history with over 731,000 transactions processed in a single day.

- Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026

- XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun

- Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- Bitcoin Price Prediction: Alarming New Research Warns Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Protected?

- XRP Price Could Explode After Tokenization Deal With Fund Manager

- Leading AI Claude Predicts the Price of XRP, Cardano and Ethereum By the End of 2026

- XRP Price Prediction: Could XRP Really Flip Bitcoin and Ethereum? One Analyst Says the Battle Has Already Begun

- Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto