EU Council Greenlights Digital Euro With ‘Offline’ Mode — Is Privacy Finally Secured?

The European Union has agreed on its negotiating position for legislation that would allow the European Central Bank to issue a digital form of the single currency, including an offline version designed to function without internet access.

The decision does not authorize issuance, but it clears the way for negotiations with the European Parliament and brings long-running debates over privacy, resilience, and political oversight into sharper focus.

Offline, Private, Digital: Is Europe Rebuilding Cash in Code?

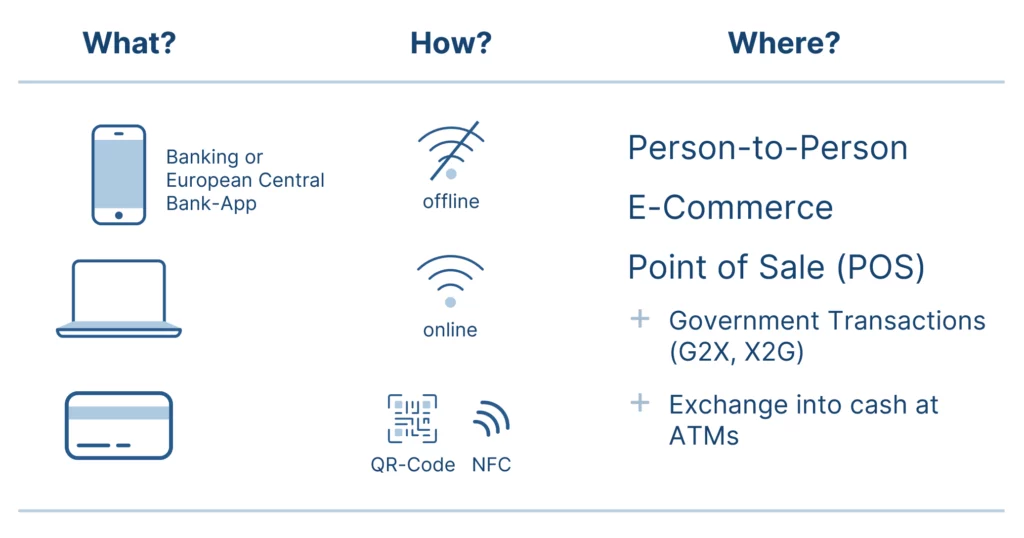

A document released on Friday laid out the council’s stance, confirming that the digital euro would launch with both online and offline payment options.

EU officials say this two-track approach is meant to keep central bank money relevant as the economy becomes more digital while still preserving features traditionally associated with cash.

On the technical side, the European Central Bank has largely finished its groundwork after a two-year preparation phase that concluded in October 2025.

ECB President Christine Lagarde said last week that the technical work is done and that the next steps now depend on lawmakers.

She added that political institutions will decide whether the European Commission’s proposal is adopted as written or changed.

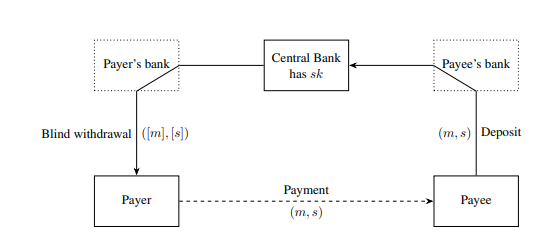

Much of the debate has focused on the offline option, which has raised privacy questions. Under the ECB’s design, offline payments would allow two users to exchange digital euro tokens directly between certified devices, such as smartphones or smart cards, with transaction details known only to the payer and payee.

Only the funding and defunding of the offline wallet would be recorded, a structure the ECB says offers a level of privacy comparable to cash for low-value payments.

Why the Digital Euro Can’t Fully Match Cash Privacy

At the same time, experts and regulators have acknowledged technical limits. The European Data Protection Board has warned that enforcing physical proximity in a digital system is difficult, as relay attacks could theoretically bridge near-field communication signals over the internet.

The board concluded that physical proximity, a defining feature of cash, cannot be reliably guaranteed in digital currency systems, even with safeguards in place.

As a result, the offline digital euro is described as highly private but not fully anonymous in the way physical cash is.

The online version is designed to support everyday digital payments, including e-commerce and remote transfers.

For these transactions, the ECB would see only pseudonymized data, meaning payments could not be directly linked to individuals.

Banks and other payment service providers would access only the information required to comply with EU anti-money laundering and counter-terrorism financing rules and would be barred from using payment data for commercial purposes without user consent.

Two Modes, One Goal: Inside the ECB’s Digital Euro Plan

ECB officials have stressed that the central bank has no interest in monetizing transaction data.

Beyond privacy, the two versions serve different practical roles. The offline digital euro is intended as a resilience tool, allowing payments to continue during network outages or power disruptions and supporting financial inclusion for people without reliable internet access.

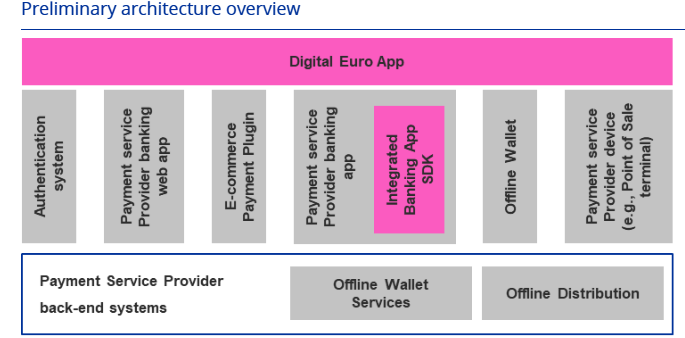

The online version is meant to integrate with existing digital infrastructure, offering convenience, security, and compatibility with private payment services operating across the euro area.

The Council’s position also sets limits on how many digital euros individuals can hold to prevent large shifts of deposits away from commercial banks.

Fees for basic services would be prohibited for consumers, while additional services could carry charges.

The framework would also require device makers to grant payment providers fair access to hardware and software needed to support digital euro wallets.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Gemini AI Predicts the Price of XRP, ETH, and BNB For the Beginning of 2026

- XRP ETPs Absorb $70M as Institutions Rotate Out of Bitcoin

- XRP Price Prediction: ETFs Hit 29-Day Inflow Streak While “World’s Highest IQ” Predicts $3 in 48 Hours – Reality Check

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- Gemini AI Predicts the Price of XRP, ETH, and BNB For the Beginning of 2026

- XRP ETPs Absorb $70M as Institutions Rotate Out of Bitcoin

- XRP Price Prediction: ETFs Hit 29-Day Inflow Streak While “World’s Highest IQ” Predicts $3 in 48 Hours – Reality Check