Ethereum Might Face Supply Squeeze – Researcher

- SEC's Gag Rule on Settlements Criticized by Commissioner Hester Peirce

- Billionaire Biohacker Bryan Johnson Dives into NFT Realm with Drip Solana Airdrop

- Coinbase Grapples with Regulatory Challenges, Analysts Forecast Volatility Ahead

- Analysts Foresee a Bitcoin ETF Offering by Charles Schwab – Trillions to Enter the Market?

- AI and Crypto Mining to More Than Double Energy Use by 2026, Report Says

With the roll-out of staking on Ethereum (ETH), as well as DeFi protocols like yearn.finance (YFI) introducing ETH vaults, the market for the second-most valuable cryptoasset may be about to get significantly tighter, US-based crypto research firm Delphi Digital has warned.

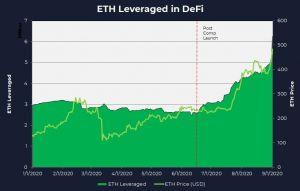

The case for what appears to be a perfect storm for the price of ETH was laid out by Alex Gedevani, a researcher at the firm, in a report published yesterday. He noted that “ETH leveraged in DeFi has surged to $6.3 million,” growing by 47% in a month.

According to Gedevani, it is the combination of the ETH staking, ETH deposited to mint DAI via yearn.finance’s newly launched yETH vault, and “buy pressure from yield farming earnings converted to ETH,” that will lead to a “supply sink” of ETH.

More than ETH 1.2m (USD 517m) are already staked on Medalla, the final Ethereum (ETH) 2.0 testnet before Phase 0 (the Beacon Chain) of ETH 2.0, according to beaconcha.in data. As some estimate, Phase 0 might be launched in November this year, unless “severe bugs” are found in clients or protocol.

Also, the mentioned yETH vault from yearn.finance has already received a fair share of attention in the cryptoverse.

“This vault is currently earning over 100% APY (minus fees) and is what I like to call a “black hole” for ETH – that is, once ETH goes in, it isn’t likely to come out,” Anthony Sassano, Co-founder of Etherhub and the product marketing manager at SetProtocol, said in his newsletter today.

As a result of the current DeFi frenzy taking place on Ethereum, transaction fees on the network has also been pushed up to all-time highs. However, according to on-chain analysis firm Glassnode, however, the high fees have rewarded miners handsomely, with the group collectively raking in over USD 500,000 in just one hour yesterday.

At pixel time (16:25 UTC), ETH trades at USD 434 and is down by almost 10% in a day, trimming its weekly gains to less than 11%. Meanwhile, ETH trading volume surpassed USD 22bn in the past 24 hours and is now by USD 800m bigger than BTC trading volume.

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- XRP Price Prediction: Billionaire Who Once Mocked XRP Now Praises It – Big Announcement Coming?

- Bitcoin Price Prediction: Record SEC Filings Signal Flood of Wall Street Money – Supercycle Starting in 2026?

- China’s DeepSeek AI Predicts the Price of XRP, Solana, Cardano by the End of 2026

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- XRP Price Prediction: Billionaire Who Once Mocked XRP Now Praises It – Big Announcement Coming?

- Bitcoin Price Prediction: Record SEC Filings Signal Flood of Wall Street Money – Supercycle Starting in 2026?

- China’s DeepSeek AI Predicts the Price of XRP, Solana, Cardano by the End of 2026

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto