Crypto Rally Fades as Geopolitical Risks Re-Enter Focus: Laser Digital

Cryptocurrency markets began last week on firm footing supported by aggressive institutional buying and continued inflows into spot Bitcoin exchange-traded funds (ETFs).

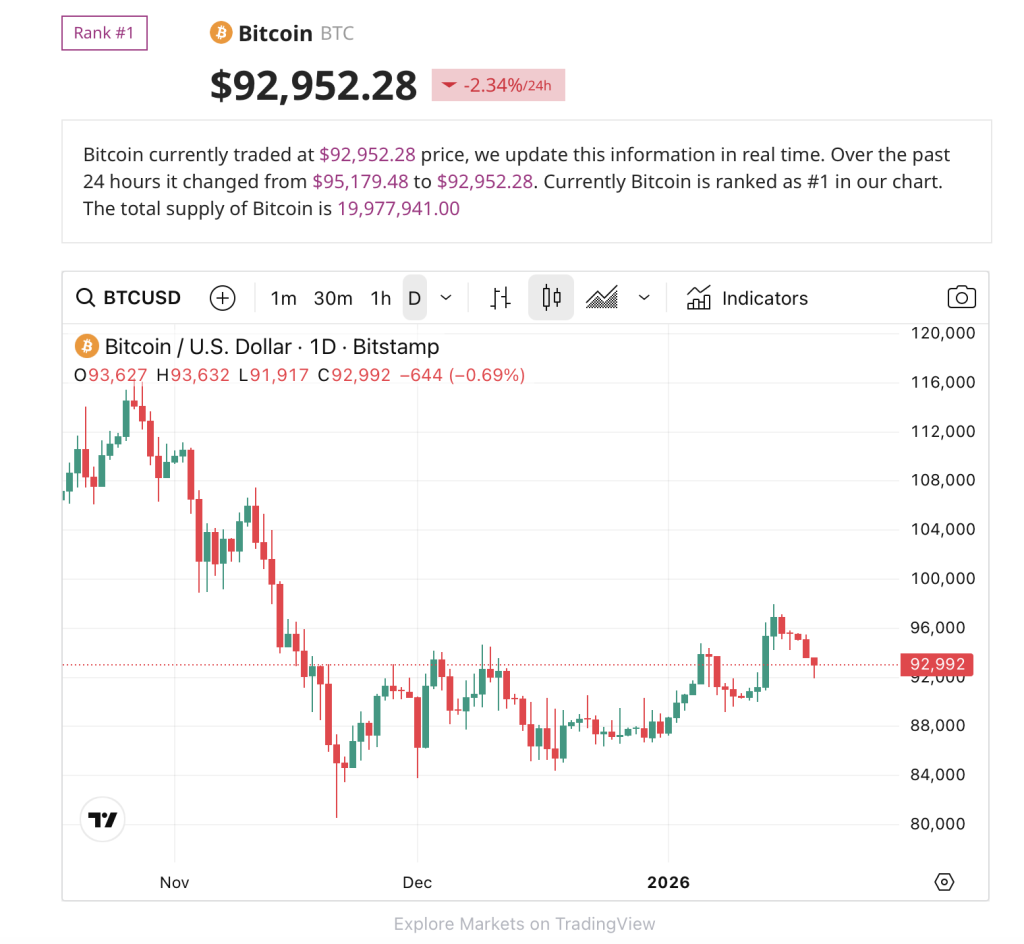

Bitcoin finally broke above the closely watched $95,000 resistance level after multiple failed attempts in recent weeks rallying into a $97,000–$98,000 range. The move was triggered by sustained demand from large corporate buyers such as MicroStrategy alongside improving sentiment around regulated investment vehicles, according to Laser Digital.

Despite the bullish breakout momentum proved difficult to maintain. As the week progressed buying pressure eased and prices began to consolidate around the $95,000 level suggesting the rally had become increasingly vulnerable to macro-driven shocks.

Tariff Headlines Trigger Risk-Off Move

Over the weekend renewed geopolitical tension weighed heavily on broader risk markets after former U.S. President Donald Trump proposed new tariff measures targeting European Union and NATO countries.

While crypto assets appeared insulated from the news sentiment deteriorated sharply once U.S. equity futures opened weaker during early Asian trading hours.

This shift triggered aggressive selling across digital assets. Bitcoin fell to approximately $92,500, while Ethereum dropped to around $3,200, effectively erasing the majority of gains recorded during the prior week.

The move highlights crypto’s continued sensitivity to global macro and geopolitical developments, particularly during periods of heightened uncertainty.

On Monday Bitcoin’s price action is showing near-term consolidation after a sharp pullback, with BTC trading around $93,000following a rejection from the mid-$90,000s.

Near-Term Outlook Hinges on Macro Developments

Looking ahead near-term price action is expected to remain highly reactive to how U.S.–EU trade tensions evolve. Any escalation could pressure risk assets while signs of de-escalation may provide room for stabilization. Geopolitical risks in the Middle East remain elevated with tensions increasing over the weekend and contributing to a more cautious market backdrop.

From a macro perspective, markets face a busy week. Key events include the World Economic Forum in Davos, upcoming U.S. GDP and PCE inflation data and a Bank of Japan policy meeting.

Although there are no scheduled Federal Reserve speeches due to the blackout period, markets may still see policy-related developments. U.S. Treasury Secretary Scott Bessent has indicated that a Fed chair announcement could occur closer to the Davos Forum, adding another potential catalyst for volatility.

Caution Returns After Breakout Attempt

While last week’s breakout above $95,000 marked a technical milestone for Bitcoin the subsequent pullback shows the fragile nature of sentiment at elevated price levels.

With macro and geopolitical risks back in focus, traders are likely to remain cautious in the near term, watching for clarity on tariffs, central bank direction and broader risk appetite before committing to the next directional move.

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- XRP Price Prediction: When Traders Get This Quiet, XRP Has a History of Going Wild – Is It About to Happen Again?

- China’s DeepSeek AI Predicts the Price of XRP, Cardano and Solana By the End of 2026

- XRP Price Prediction: Price Holds Strong as ETF Inflows Quietly Return – Do Whales Know Something?

- XRP Price Prediction: XRP Nears Accumulation Breakout as $1.85 Holds – Bulls Target $4

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- XRP Price Prediction: When Traders Get This Quiet, XRP Has a History of Going Wild – Is It About to Happen Again?

- China’s DeepSeek AI Predicts the Price of XRP, Cardano and Solana By the End of 2026

- XRP Price Prediction: Price Holds Strong as ETF Inflows Quietly Return – Do Whales Know Something?

- XRP Price Prediction: XRP Nears Accumulation Breakout as $1.85 Holds – Bulls Target $4