Colombia’s Bancolombia Launches Crypto Exchange Wenia and Stablecoin COPW

Thomas is a junior content writer producing articles on Cryptonews.com. He’s responsible for creating the most informative and up-to-date crypto content. He’s constantly producing pieces on the...

- RNDR Price Surges Following Apple Mention of Render Network's Octane Software

- Sam Bankman-Fried, Commodities Trader Behind Bars: Former FTX CEO's Prison Life While Awaiting Appeal

- Ghana Merges Tradition and Technology with NFT Stamp Collection

- South Korean Mart Dishes Up Bitcoin-Themed Meal Packs with Crypto Exchange Bithumb

- Grayscale's Bitcoin ETF Sees Small Inflows Following $17.4B Loss

Bancolombia Group, Colombia’s largest bank, launched the cryptocurrency exchange Wenia on May 3, marking a major step in the country’s crypto evolution.

According to the announcement, the development follows nearly a decade of research and signifies the bank’s dedication to Colombia’s crypto market.

Colombia’s Wenia and COPW

Wenia, alongside the newly introduced Colombian peso stablecoin COPW, which has a 1:1 parity to the Colombian peso, seeks to attract 60,000 users in its first year. The platform’s goal is to compete with major crypto exchanges like Binance and Coinbase, offering trading in Bitcoin, USD Coin, Polygon, Ether, and, of course, the COPW stablecoin.

By catering to both experienced and novice traders, Wenia seeks to solidify Colombia’s position as a leader in crypto adoption within Latin America.

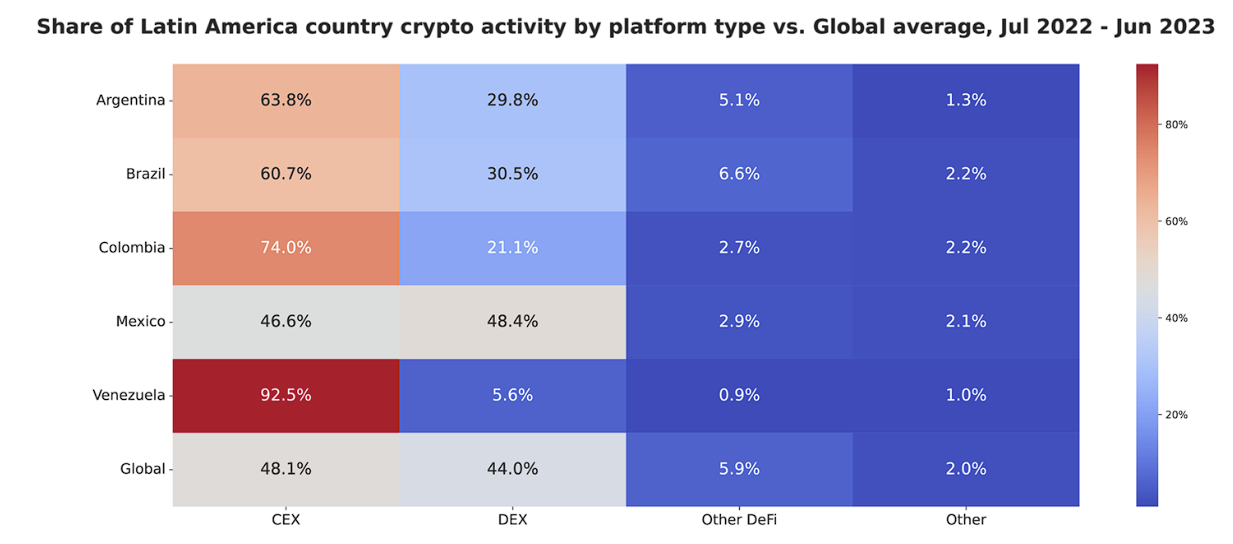

Access to the exchange requires Colombian residency, aligning with the nation’s rising prominence in the global crypto market. Colombia currently holds third place in the 2023 Global Crypto Adoption Index among Latin American countries, demonstrating considerable interest in crypto assets within the region.

Juan Carlos Mora, president of Bancolombia Group, highlighted the bank’s decade-long journey to develop a platform that facilitates the adoption of digital assets and blockchain technology. This move underscores Bancolombia’s commitment to innovation within the Colombia crypto sphere.

Risks of Colombia’s Crypto Investments

While this development presents exciting opportunities, Bancolombia emphasized the importance of understanding the risks associated with digital assets. These assets lack deposit insurance and carry inherent risks like volatility and potential loss. Additionally, no entity within the Bancolombia Group participates directly in digital asset transactions. The bank also cautioned traders about the absence of government backing or guaranteed safe storage methods for these assets.

Additionally, a lawyer posted on LinkedIn about Wenia’s independent status as an entity registered in Bermuda. Any legal claims or disputes would fall under the jurisdiction of Bermuda courts, involving Wenia directly, not Bancolombia.

- Crypto Price Prediction Today 16 February – XRP, Ethereum, Cardano

- Bitcoin Price Prediction: 12-Year Trend Shattered Has Broken – Is “Quantum Computing” Secretly Killing Bitcoin?

- Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- XRP Price Prediction: Deadly “Gravestone Doji” Spotted – Can XRP Go to Zero?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- Crypto Price Prediction Today 16 February – XRP, Ethereum, Cardano

- Bitcoin Price Prediction: 12-Year Trend Shattered Has Broken – Is “Quantum Computing” Secretly Killing Bitcoin?

- Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

- XRP Price Prediction: Deadly “Gravestone Doji” Spotted – Can XRP Go to Zero?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto