Coinbase Says That 60% of Its Bitcoin Buyers Go Into Altcoins

Tim Alper is a British journalist and features writer who has worked at Cryptonews.com since 2018. He has written for media outlets such as the BBC, the Guardian, and Chosun Ilbo. He has also worked...

- Naver-Dunamu Crypto ‘Mega-Company’ Could Be Worth $2.1B a Year – Experts

- Russia Losing ‘Millions of Dollars a Year to Illegal Crypto Miners’ – Report

- Russian Economist: BTC Will Hit $120k-$130k Again Before End of Year

- Russia’s Central Bank: Tokenization Will Let Foreigners Buy Domestic Shares

- S Korean Tax Agency: Pay Your Bills or We’ll Take Your Crypto Cold Wallets

Major cryptoasset exchange Coinbase claims that although most of its users initially favor bitcoin (BTC), the vast majority also go on to trade altcoins and other digital assets.

In a blog post, the platform claimed,

“Among customers with at least five purchases, 60% start with bitcoin but just 24% stick exclusively to BTC.”

It means that 60% of BTC buyers on Coinbase are going into altcoins eventually.

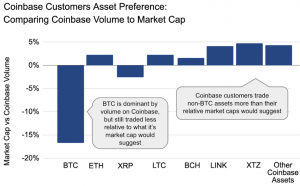

In total, it claims that “over three quarters” of its customers “eventually buy other assets” – namely altcoins. Furthermore, Coinbase says its customers “trade non-BTC assets at a roughly 3% higher rate than their relative market caps would suggest.”

Bitcoin’s market capitalization dominance (almost 67% today) has been all but unchallenged since its inception, but Coinbase’s claims would appear to indicate that for some people BTC is a gateway to further investment, with altcoins growing in popularity.

The blog’s author wrote that Coinbase “sees a trend where bull markets show increasing traction among alternative assets.”

This could be for a variety of reasons, the exchange opined, “but one is largely psychological.”

The author explained,

“As people feel good about their initial crypto investments (in bitcoin), they branch out to find other possible categorical winners (as evident in the 2017 bull run).”

However, bitcoin remains most investors’ safety net of choice, per the author, who added, that “the converse is also possible, as prices drop and fear grips the market (2018–2019), a flight to crypto safety drove bitcoin back to the forefront.”

Coinbase admitted that this “increasing drive” to non-BTC assets “is in part due to” its own business strategy that has involved the “continued addition” of new altcoins and other tokens.

However, it claimed that “price volatility significantly swings consumer behavior toward non-BTC assets.”

Moves away from BTC occurred in 2017, and are “now evident in large spikes,” with early 2020 drives toward ethereum (ETH), tezos (XTZ) and chainlink (LINK).

The author concluded with a poetic flourish, writing,

“Bitcoin is king, and likely to remain king for a long time. But it is also paving the way for a thousand flowers to bloom.”

___

Learn more: Interest in Buying Bitcoin Is Highest In More Than Two Years

- China’s DeepSeek AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

- Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto

- Bitcoin Price Prediction: Satoshi’s Wallet Just Got $174K in BTC – Is the Creator About to Return?

- Solana Price Prediction: SOL Bounces 12% Overnight – But This One Signal Could Ruin Everything

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- China’s DeepSeek AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

- Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

- Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto

- Bitcoin Price Prediction: Satoshi’s Wallet Just Got $174K in BTC – Is the Creator About to Return?

- Solana Price Prediction: SOL Bounces 12% Overnight – But This One Signal Could Ruin Everything

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto