Assets Invested in Crypto ETFs and ETPs Soar to Record High of $91.69B: ETFGI

Tanzeel Akhtar has been reporting on cryptocurrency and blockchain technology since 2015. Her work has appeared in leading publications including The Wall Street Journal, Bloomberg, CoinDesk, Bitcoin...

- Binance Seeks MiCA Approval in Greece Ahead of EU Regulatory Deadlines

- Bitcoin Enters Loss Realization Phase as On-Chain Profit Dynamics Flip Negative: CryptoQuant

- Billionaire Michael Saylor Hints at More Bitcoin Buying in Mid-Week Post

- BitGo Debuts on New York Stock Exchange Trading Under Ticker BTGO

- DEX Aggregator 1inch Expands Gasless DeFi Access Through Rewardy Wallet Integration

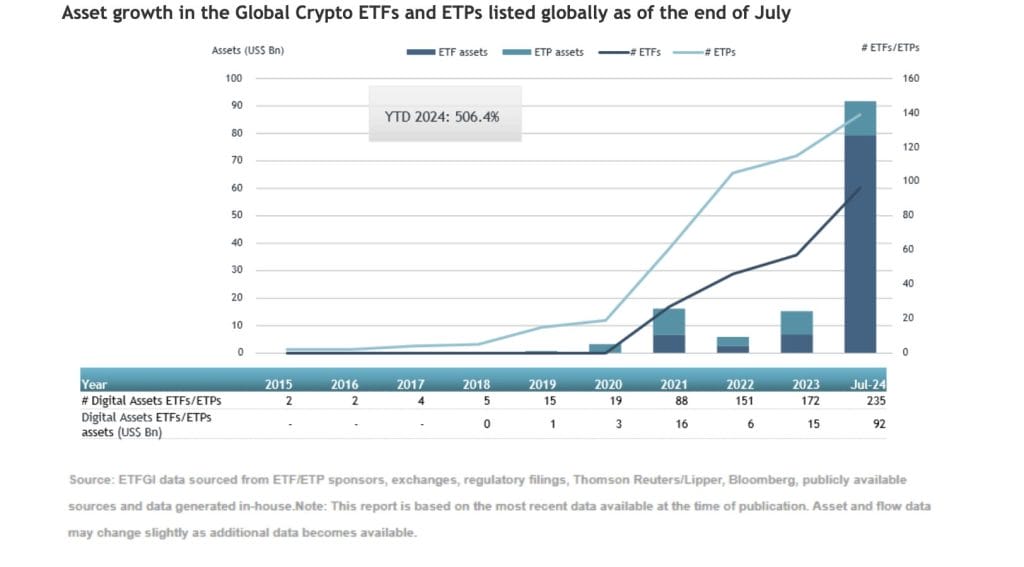

Assets invested in cryptocurrency exchange-traded funds (ETFs) and exchange-traded products (ETPs) have hit a record new high of $91.69 billion at the end of July, according to data from ETFGI, an independent research firm.

ETFGI notes assets have increased 506.4% during 2024 going from $15.12 billion at the end of 2023 to $91.69 billion.

The first ever crypto ETP was listed in 2015, the Bitcoin Tracker One-SEK. Since then the number of products and range has increased steadily. This was the first Bitcoin-based security available on a regulated exchange. The sector has come a long way since with players such as BlackRock iShares and Fidelity entering the space with new spot Bitcpon ETFs.

In July alone crypto ETFs and ETPs listed globally gathered net inflows of $13.65 billion, bringing year-to-date net inflows to $59.25 billion.

Global ETFs ETPs Listed Rises to 235

There are a total of 235 Crypto ETFs and ETPs listed globally with 588 listings, and assets of $91.69 Bn, from 52 providers listed on 22 exchanges in 16 countries at the end of July 2024, notes ETFGI.

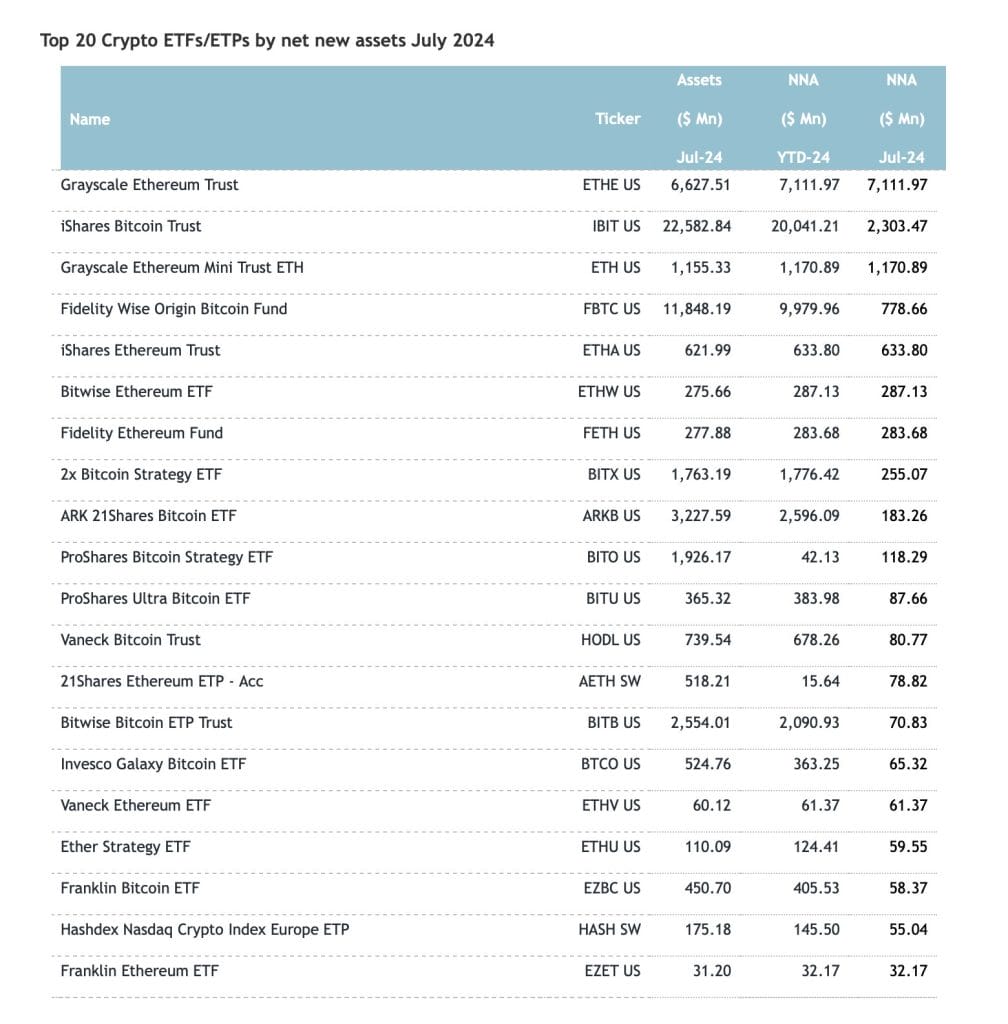

The inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $13.78 billion during July.

The Grayscale Ethereum Trust (ETHE US) gathered $7.11 billion, the largest individual net inflow in July, notes ETFGI. Followed closely by BlackRock’s IBIT ETF.

Grayscale Ethereum Trust Sees Largest Inflows

Most recently spot Bitcoin ETFs in the U.S. have registered their eighth consecutive day of positive net inflows.

On Monday alone, the funds accumulated a total of $202.51 million in inflows, indicating continued investor interest in Bitcoin despite recent market fluctuations.

- Elon’s Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- Crypto Price Prediction Today 21 January – XRP, Bitcoin, Ethereum

- XRP Price Prediction: XRP Nears Accumulation Breakout as $1.85 Holds – Bulls Target $4

- XRP Price Prediction: Ripple Is Now Aligned With U.S. Lawmakers – Is This the Moment XRP Becomes Unstoppable?

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- Elon’s Grok AI Predicts the Price of XRP, Solana and PEPE By the End of 2026

- New ChatGPT Predicts the Price of XRP, Bitcoin and Dogecoin By the End of 2026

- Crypto Price Prediction Today 21 January – XRP, Bitcoin, Ethereum

- XRP Price Prediction: XRP Nears Accumulation Breakout as $1.85 Holds – Bulls Target $4

- XRP Price Prediction: Ripple Is Now Aligned With U.S. Lawmakers – Is This the Moment XRP Becomes Unstoppable?

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto