Another Major S Korean Bank Now Set to Join Bitcoin Custody Race

Tim Alper is a British journalist and features writer who has worked at Cryptonews.com since 2018. He has written for media outlets such as the BBC, the Guardian, and Chosun Ilbo. He has also worked...

- Naver-Dunamu Crypto ‘Mega-Company’ Could Be Worth $2.1B a Year – Experts

- Russia Losing ‘Millions of Dollars a Year to Illegal Crypto Miners’ – Report

- Russian Economist: BTC Will Hit $120k-$130k Again Before End of Year

- Russia’s Central Bank: Tokenization Will Let Foreigners Buy Domestic Shares

- S Korean Tax Agency: Pay Your Bills or We’ll Take Your Crypto Cold Wallets

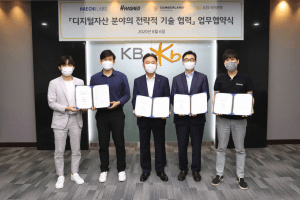

Kookmin Bank (KB), one of South Korea’s biggest commercial banks, could be set to move into crypto sector business after the KB Group, the company that operates the bank, signed a “digital assets” cooperation deal with three major domestic blockchain firms.

And it looks as though KB could be heading into the crypto custody business. The move follows on from an announcement by one of its biggest rivals, Nonghyup Bank (NH), which last month announced it would launch custody services for institutional investors.

The terms of the KB deal pertain to “the storage and management of digital assets,” per E Today.

The firms – smart contract specialist Haechi Labs, blockchain accelerator Hashed and crypto trading platform Cumberland Korea – penned the deal with the head of the KB Group’s IT unit.

The companies also agreed to coordinate a “joint response to regulatory changes,” and look into “new business models that make use of blockchain technology” – as well as build up an ecosystem that links blockchain technology and the conventional finance sector.

The head of the KB Group’s IT unit stated that he hoped KB and the blockchain firms would “grow together by discovering innovative services in the digital asset sector.”

He added that KB hoped to “expand” its crypto operations in the future.

In a separate statement, Simon Kim, CEO of Hashed, said that this new partnership “will inevitably open new doors to consumers as well as to the country in ushering the new era of digital transformation.”

The media outlet said that banks expect fiat currency, real estate, artworks and digital rights to be issued and traded as digital assets in the near future, in addition to crypto assets – a factor that is driving banks toward adoption.

Industry players have previously told Cryptonews.com that other commercial banks in the country could soon unveil their own crypto custody plans in the months or weeks ahead.

____

Learn more:

Lobbyist Asks US Regulator to Let Banks Deal In Privacy Coins

US Banks Offering Crypto Custody is ‘Insanely’ Bullish and Risky

Bitcoin Brokers In ‘Very Important’ Race For Big Investors – BitGo Prime CEO

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- XRP Price Prediction: Three Straight Red Days – Is This Just a Pullback or the Start of a Panic Selloff?

- Ethereum Price Prediction: Big Money Is Leaving Bitcoin – Are Institutions Quietly Flipping Bullish on ETH?

- Why Is Crypto Up Today? – January 9, 2026

About Us

2M+

250+

8

70

Market Overview

- 7d

- 1m

- 1y

- Crypto Market Prospect: After the Washout, the Soil Looks Richer

- [LIVE] Fed Payments Innovation Conference: Real-Time Updates as Federal Reserve Discusses Crypto, Stablecoins, and AI with Industry Leaders

- XRP Price Prediction: Three Straight Red Days – Is This Just a Pullback or the Start of a Panic Selloff?

- Ethereum Price Prediction: Big Money Is Leaving Bitcoin – Are Institutions Quietly Flipping Bullish on ETH?

- Why Is Crypto Up Today? – January 9, 2026

More Articles

Get dialed in every Tuesday & Friday with quick updates on the world of crypto