‘People Will Die’ After Coinbase Data Leak, Millionaire Warns

An early investor in Coinbase has just made a stunning intervention — and suggested executives should be jailed for failing to protect customer information.

The multimillionaire Michael Arrington, who also founded TechCrunch, launched a blistering attack on X in response to last week’s data theft.

In an extraordinary post that pulled no punches, he warned the leak of home addresses and account balances of Coinbase users “will lead to people dying.”

Arrington even suggested “it probably has already,” but it’s important to stress that there’s nothing concrete to back up this assertion. He wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people.”

He went on to say that he is “very disappointed in Coinbase right now” — and crypto companies should urgently review their business models.

“Using the cheapest option for customer service has its price. And Coinbase’s customers will bear that cost.”

Coinbase broke its silence last week with a detailed blog post, in which it admitted that criminals had bribed some of its overseas customer service agents to hand over sensitive details belonging to “a small subset” of users.

The exchange was quite upfront about what happened — and said it had refused to pay a $20 million ransom in order to cover the breach up.

While it insisted less than 1% of monthly transacting users were affected, that’s a substantial amount considering how many people have a Coinbase account.

And given the breach included home addresses, balance snapshots, transaction histories and copies of photo ID, the data that has been compromised could cause a lot of damage.

Coinbase’s initial blog post vowed that work has now begun to trace stolen funds — confirming that some customers have lost crypto as a result — with the trading platform later revealing the incident could cost the business up to $400 million.

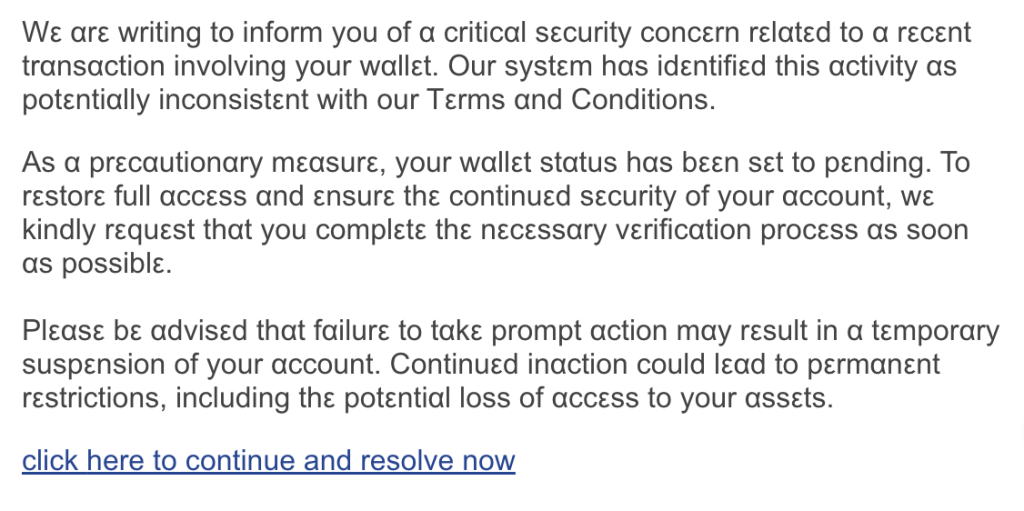

Opportunistic scammers are already trying to take advantage by sending bogus emails warning people they have fallen victim to “critical security concerns.”

Of course, this wide-ranging breach comes at a time when crypto investors have been specifically targeted in a spate of violent incidents, including kidnappings. One influencer was confronted by armed gunmen after she had (willingly) posted a screenshot of her Coinbase balance on X.

For Coinbase users told their balances have fallen into the hands of malicious actors, you can imagine recent developments will cause a lot of anxiety.

It’s now been confirmed that the U.S. Justice Department has launched an investigation into the data breach — but Coinbase’s chief legal officer Paul Grewal has stressed that the company itself is not being scrutinized.

Arrington’s bombastic post has led some in the crypto space to leap to Coinbase’s defense, arguing regulations are to blame for what happened. Balaji Srinivasan, who served as the exchange’s former chief technology officer, replied:

“The state forces companies to collect KYC data that they do not want to collect. This issue is much bigger than crypto, and regulation is the actual thing to target. With ZK, no need for KYC.”

That led Arrington to brusquely reply: “When enough people die, the laws may change.”

But it seems unusual to argue that the solution here is to stop exchanges from performing Know Your Customer checks. Instead, the focus should be on tightening the rules surrounding data collection — with stricter safeguards to prevent rogue actors from leaking confidential information, and punishing fines for companies that let their customers down.

We’re already starting to learn about some of the people affected by this incident.

An artist called Ed Suman held 17.5 BTC and 225 ETH on Coinbase, worth about $2.4 million at current market rates. He told Bloomberg that he lost it all as a result of a social engineering attack directly linked to this leak, and said the exchange should have emailed every customer to warn of impersonators — adding:

“They could have prevented a huge amount of theft. In my opinion, they’ve been woefully remiss and, in my case, the consequences of that have been significant.”

This sorry tale overshadows the fact that Coinbase has now joined the S&P 500 — becoming the first crypto company to do so. The theft adds ammo to those who firmly believe in self-custodial solutions — using the mantra “not your keys, not your Bitcoin.”

And in the weeks and months ahead, there’s likely to be further drama as the breach is investigated and new revelations unfold. Michael Arrington is now on the warpath — and won’t be the only one.

- XRP Price Prediction: Retail Is Disappearing, On-Chain Activity Collapses – Is XRP Quietly Dying?

- Bitcoin Price Prediction: Wall Street Just Bet Half a Billion on BTC – And Ignored Ethereum and XRP Completely

- XRP Price Prediction: $4B Volume Swells as XRP Slips to $1.60—Is $1.55 Next?

- We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin and Ethereum By the End of 2026

- We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana and Bitcoin By the End of 2026

- XRP Price Prediction: Retail Is Disappearing, On-Chain Activity Collapses – Is XRP Quietly Dying?

- Bitcoin Price Prediction: Wall Street Just Bet Half a Billion on BTC – And Ignored Ethereum and XRP Completely

- XRP Price Prediction: $4B Volume Swells as XRP Slips to $1.60—Is $1.55 Next?

- We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin and Ethereum By the End of 2026

- We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana and Bitcoin By the End of 2026