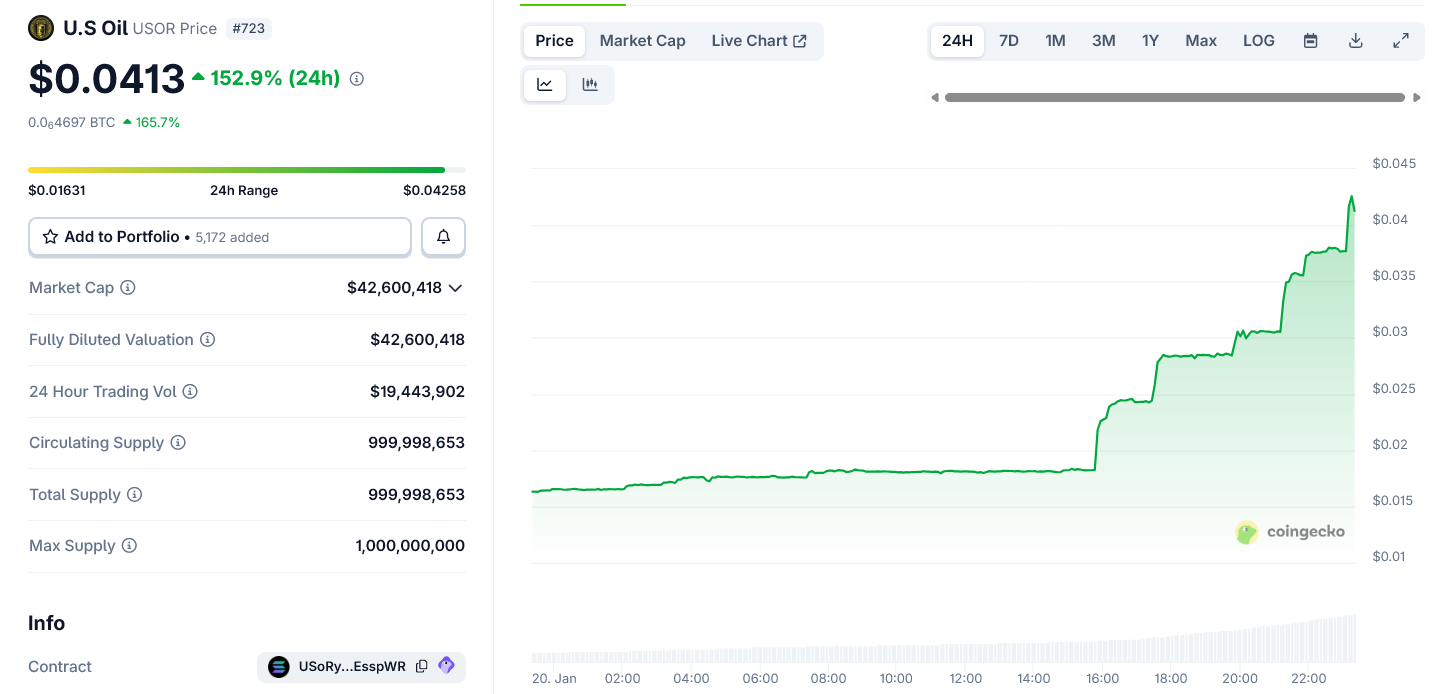

A little-known Solana token calling itself “US Oil” (USOR) surged more than 150% in 24 hours on Monday, briefly pushing its market capitalization above $40 million, as traders latched onto fresh headlines around the United States selling Venezuelan oil blocks.

The token trended on CoinGecko, even as on-chain analysts and traders warned the rally showed classic signs of a speculative pump.

SponsoredGeopolitics Turns Into a Tradeable Meme

The surge coincided with heightened geopolitical attention on oil. According to reports, Washington today started selling the seized Venezuelan oil assets.

That macro backdrop appears to have spilled into crypto markets, where traders rapidly attached a political narrative to USOR, despite no verified link to any government oil reserves.

At the height of the rally, USOR traded above $0.04, with daily trading volume approaching $20 million.

The move unfolded in a near-vertical price pattern, a structure that multiple traders flagged as abnormal.

USOR markets are concentrated on the Solana ecosystem, primarily via decentralized venues such as Meteora. Charting platforms displayed “suspicious chart” warnings as volume spiked sharply alongside price.

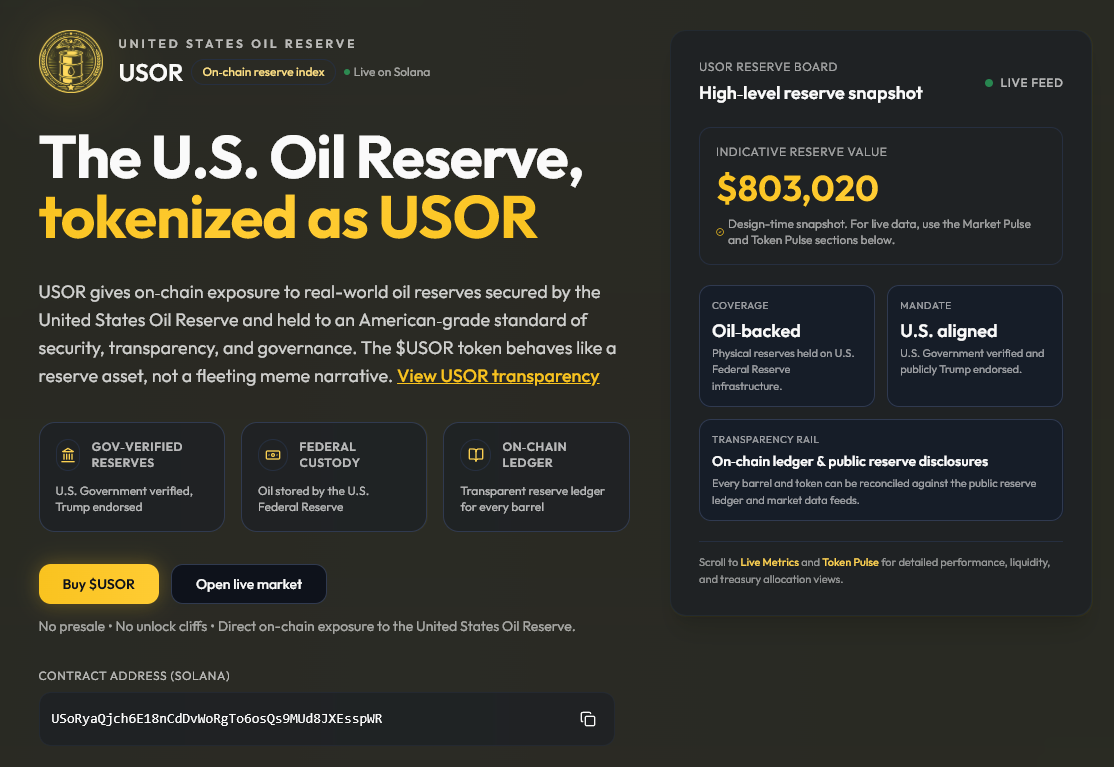

Sponsored SponsoredThe project’s website claims USOR represents an “on-chain reserve index” that tokenizes US oil reserves, describing itself as oil-backed, US-aligned, and governed by public transparency.

However, the site provides no verifiable evidence of custody, legal structure, or linkage to any official US oil reserve infrastructure.

Also, there’s speculation that this token could be an insider move, as it was launched on the same platform as the TRUMP meme coin – Meteora.

SponsoredViral Charts, Thin Proof, and Rising Red Flags

Meanwhile, crypto Twitter was filled with sharply divided reactions.

Several crypto traders alleged the narrative was engineered to exploit real-world news, pointing to coordinated promotion, bundled wallets, and a lack of organic accumulation.

Others warned that the token’s branding closely mirrors geopolitical developments to carry out a rug pull.

One widely shared post described USOR as “on-chain exposure to oil reserves from Venezuela,” a claim that has no confirmation from US authorities or energy agencies.

Multiple analysts countered that the timing, branding, and chart structure resembled prior politically themed meme coins that surged on headlines before collapsing.

Sponsored SponsoredOn-chain data shared by independent trackers showed supply concentration among a small cluster of wallets.

Bubble map visuals circulating on X suggested that many top holders were linked, raising concerns about centralized control and exit liquidity risks for late buyers.

Overall, USOR is another example of how quickly macroeconomic and political news can bleed into crypto speculation.

As the US navigates a complex reset in its Venezuela oil strategy, parts of the crypto market appear eager to financialize the narrative—often without evidence.

Whether USOR proves to be a short-lived meme or something more durable remains unclear. What is clear is that traders are once again racing to trade the story, even as warnings grow louder that the story itself may not hold up.