Bitcoin price action has remained mixed in recent sessions, reflecting uncertainty across global markets. At the time of writing, broader risk cues offer little direction for short-term momentum.

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin Is Tracking Gold

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive asset. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems from rising risk appetite once capital rotates from defensive assets into higher-risk alternatives.

As gold strengthens, investors tend to seek asymmetric returns, benefiting Bitcoin inflows. This pattern has repeated several times since early 2024. Sustained gold rallies have coincided with higher Bitcoin demand, supported by both retail and institutional participation across spot and derivatives markets.

An exception emerged in October this year, when Bitcoin declined sharply alongside gold. That drop followed intensified macroeconomic pressure, including higher bond yields and tighter financial conditions. Currently, gold is regaining momentum. If Bitcoin maintains stability near current levels, it could once again benefit from this renewed risk-on shift.

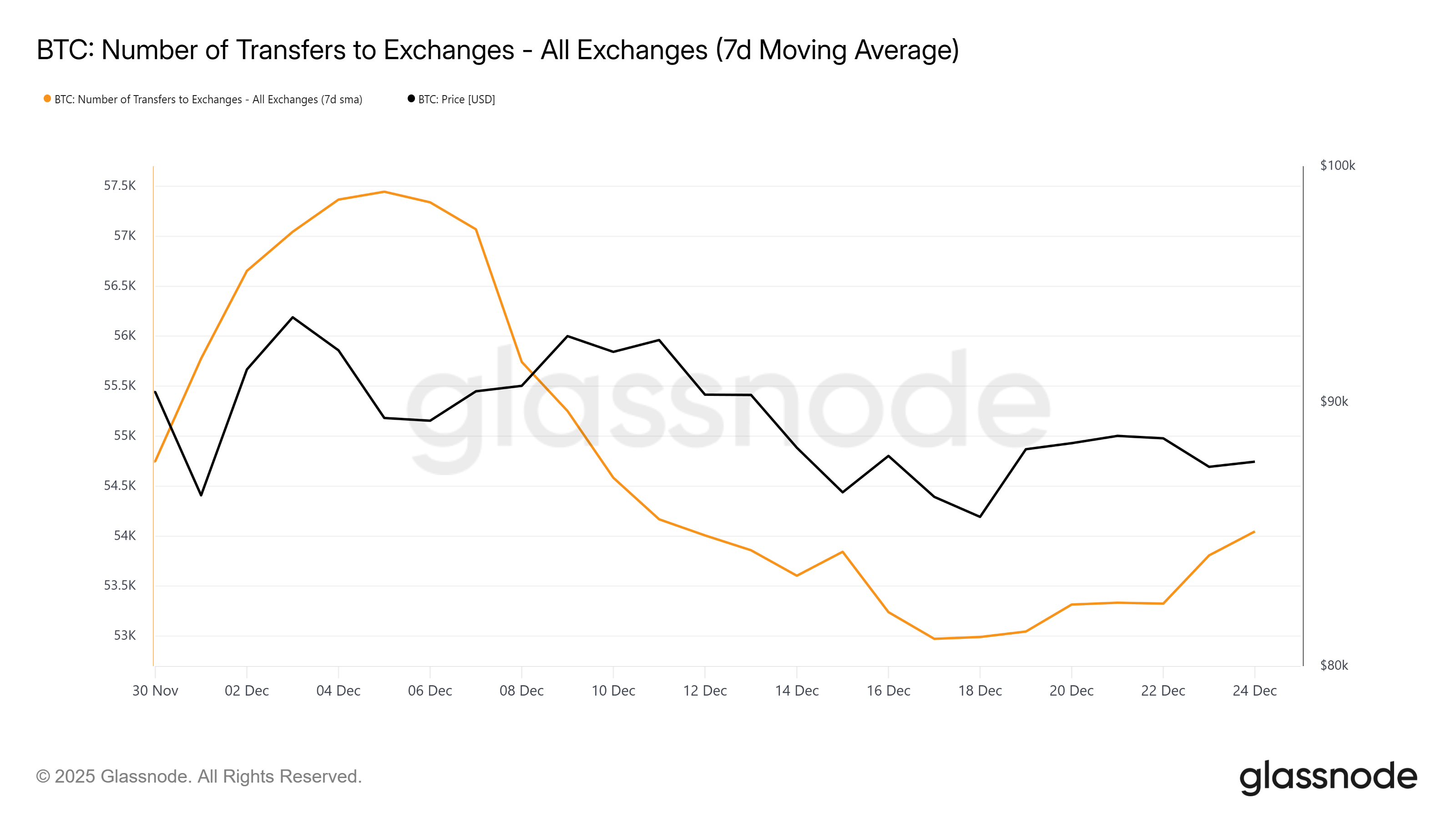

On-chain data suggests caution remains present among Bitcoin holders. Transfers to exchanges have increased in recent weeks, signaling elevated deposits from investors. This metric often reflects profit-taking behavior or preparation for potential downside protection during uncertain market phases.

Rising exchange inflows do not always signal immediate selling pressure. However, sustained increases typically precede heightened volatility. In Bitcoin’s case, growing deposits suggest some investors are managing risk rather than aggressively accumulating. This dynamic aligns with the mixed sentiment currently shaping price action.

Can BTC Price Close At No Loss?

Bitcoin price traded at $87,773 at the time of writing, sitting below the $88,210 resistance. BTC began 2025 near $93,576. For now, the primary objective remains reclaiming that level before year-end, provided market conditions improve, and volatility remains contained.

This scenario becomes more likely if Bitcoin continues tracking gold’s bullish cues. A confirmed breakout would require flipping $88,210 into support. A sustained move above $90,308 would strengthen upside conviction and signal renewed momentum across spot markets.

Conversely, increased selling pressure could disrupt this setup. If Bitcoin loses the $86,247 support, downside risks expand. A drop toward $84,698 would invalidate the bullish thesis and reintroduce near-term bearish pressure.