Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG).

This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

SponsoredDogecoin Investors Provide Support

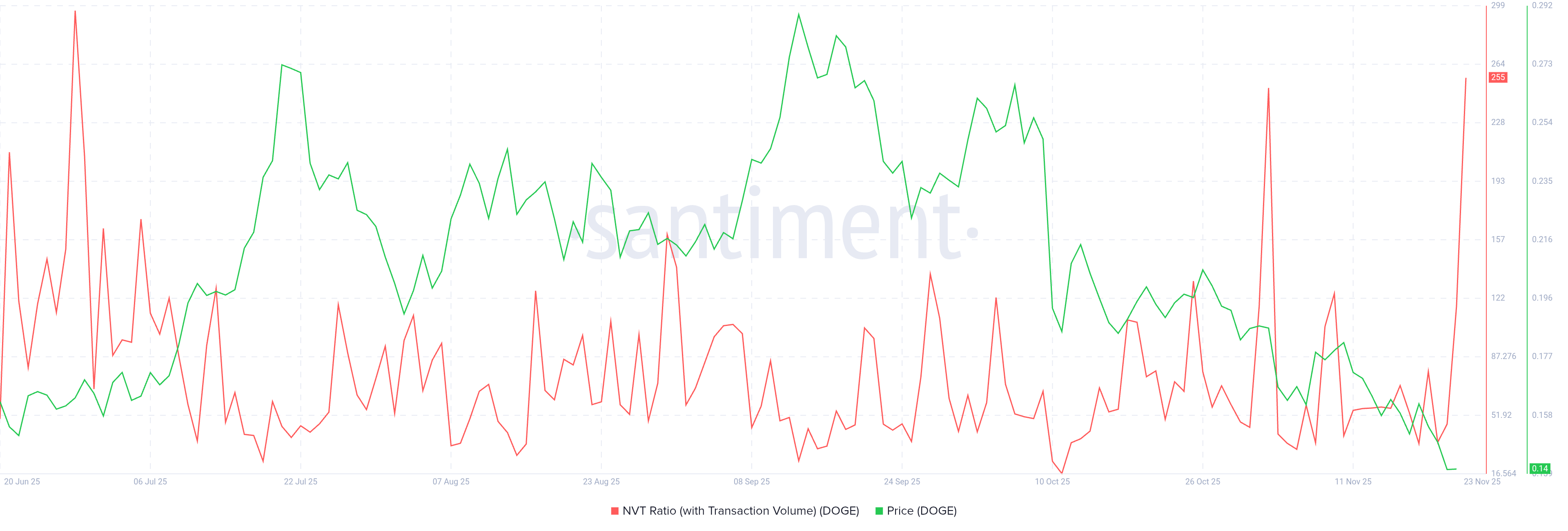

Dogecoin’s NVT Ratio is spiking sharply, signaling a disconnect between valuation and on-chain activity.

The ratio compares market capitalization with transaction volume, and a surge typically indicates limited transactional utility relative to price. While DOGE is attracting strong social attention and broad support, its actual transaction levels are not keeping pace.

This mismatch can often lead to overvaluation, which in bearish conditions may trigger a drop.

However, the timing of this spike aligns with the anticipated launch of Grayscale’s Dogecoin ETF. The ETF is expected to draw notable capital inflows, which could reset the NVT Ratio and restore balance between price and on-chain activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

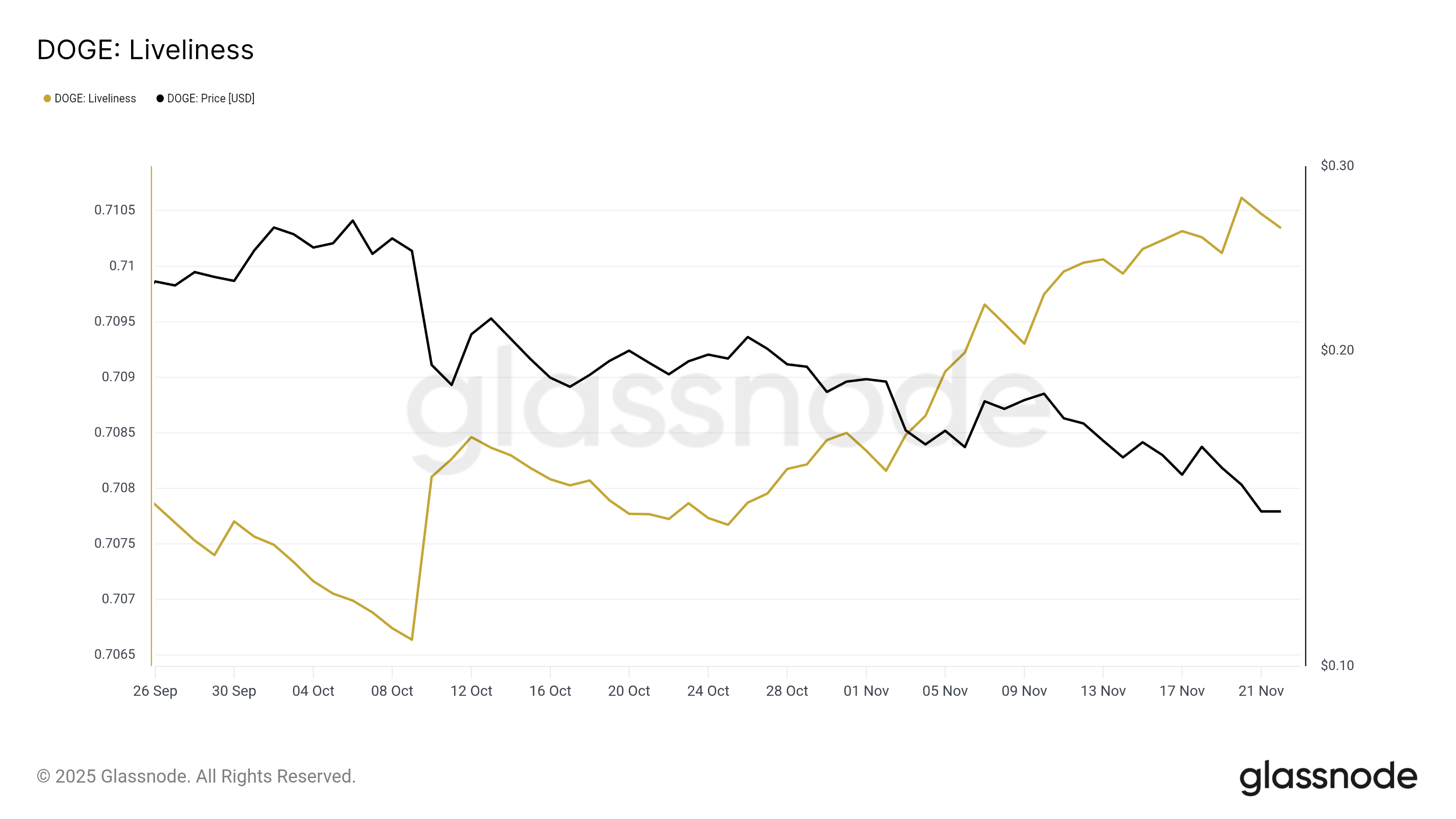

Macro indicators however, do not paint an encouraging picture. Dogecoin’s Liveliness metric has been rising for several days, indicating increased distribution behavior among long-term holders.

SponsoredLiveliness inclines when dormant coins are moved around, being spent, suggesting that key holders are protecting their positions.

This trend is particularly concerning during downturns. Long-term holders often act as the backbone of price stability, resisting volatility caused by short-term traders. This makes their selling equally impactful and as seen this month, their selling likely contributed to DOGE price fall.

Should LTHs fail to change their stance this behavior could trigger further decline in Dogecoin price.

DOGE Price Could Shoot Up

Dogecoin is trading at $0.143 and holding near the $0.142 support level. The meme coin remains trapped under a month-long downtrend that it has repeatedly failed to break. Current bearish conditions make recovery difficult without a significant catalyst.

The launch of the DOGE ETF could provide that catalyst. A successful debut may lift DOGE above $0.151, opening the path toward $0.165. A move of this scale would invalidate the downtrend and signal a shift in momentum supported by new inflows.

If the ETF hype fails to translate into buying pressure, Dogecoin could extend its decline. A drop toward $0.130 remains possible.

But if DOGE does not face a drop this sharp, it may continue struggling beneath the $0.151 resistance, prolonging the ongoing downtrend.