Bitcoin price has extended its upward momentum after breaking out of a recent consolidation pattern. The breakout signals growing confidence that BTC may be preparing for a larger move.

Rising spot Bitcoin ETF inflows mirror historical conditions that previously preceded sharp price advances, strengthening the bullish narrative forming around the asset.

SponsoredBitcoin ETFs Show Rising Demand

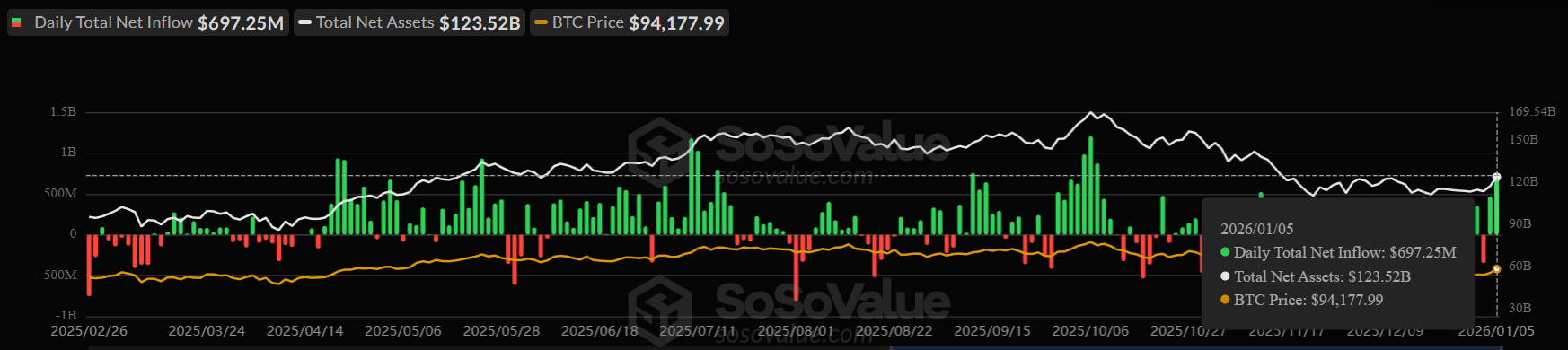

Spot Bitcoin ETFs recorded $697 million in inflows on Monday, marking the strongest single-day intake since October 2025. Such sizable inflows reflect renewed institutional participation. Historically, periods of heavy ETF accumulation have aligned with short-term price accelerations for Bitcoin.

Past instances of similar inflow spikes were followed by multi-week rallies. The current setup appears comparable, provided inflows remain consistent throughout the week. Sustained demand from ETF products reduces circulating supply and reinforces bullish sentiment across both retail and professional investor segments.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETF-driven demand often acts as a stabilizing force during volatile conditions. Unlike speculative leverage, these inflows represent longer-term positioning. Their persistence would likely support higher price discovery rather than abrupt reversals driven by short-term trading behavior.

SponsoredBitcoin Holders’ Buying Strengthens

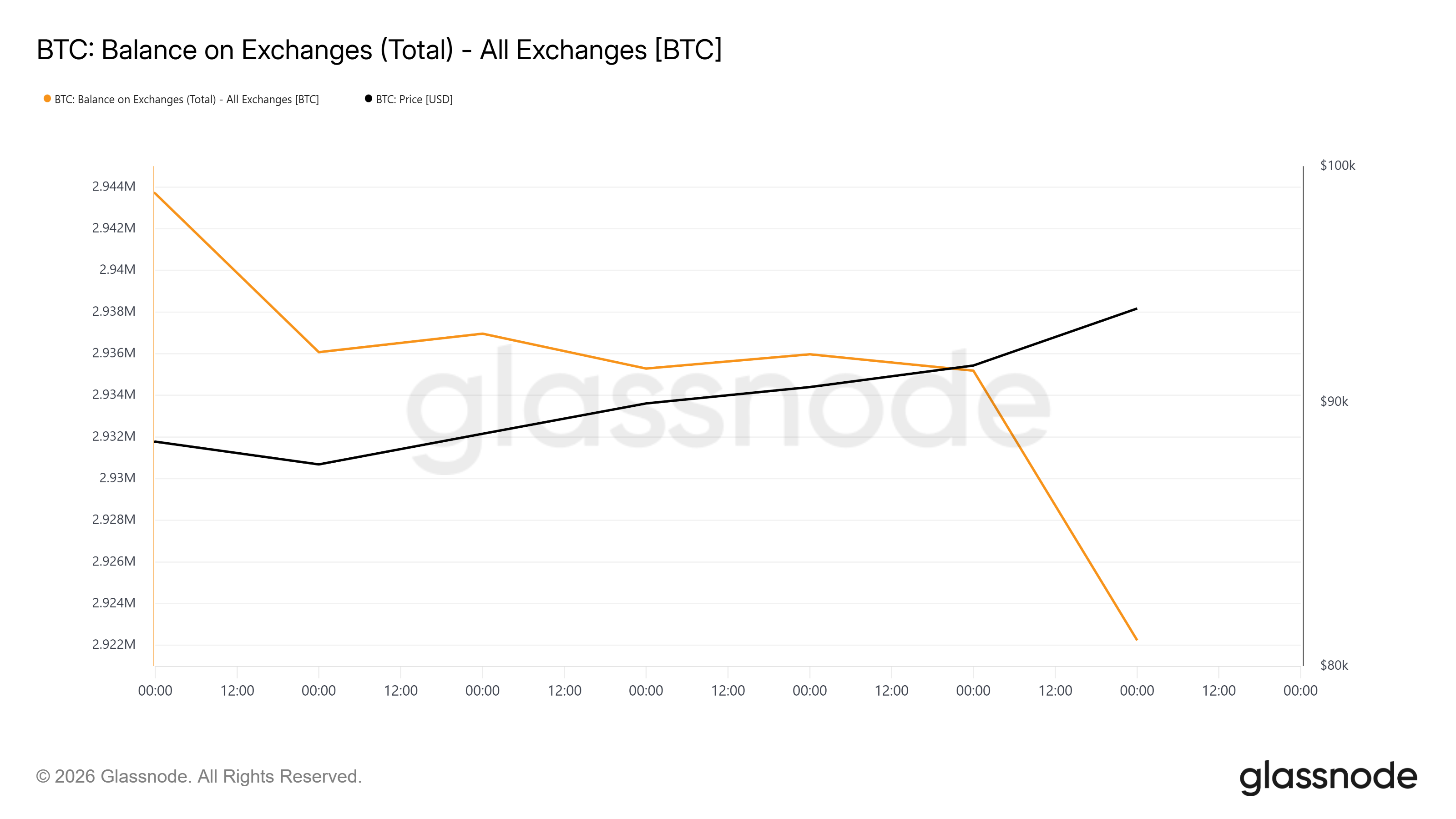

Selling pressure remains limited, according to recent exchange flow data. Over the past week, exchanges have consistently recorded net Bitcoin outflows. This trend indicates investors prefer self-custody rather than immediate liquidation, a constructive signal during price advances.

In the last 24 hours alone, approximately 12,946 BTC were withdrawn from exchanges, valued at $1.2 billion. Such movements suggest active buying rather than defensive repositioning. Reduced exchange balances limit available supply, helping sustain upward price momentum.

When price rises alongside exchange outflows, rallies tend to be healthier. Buyers appear willing to absorb supply without triggering panic selling.

SponsoredShort-Term Holders Capitalize On The Opportunity

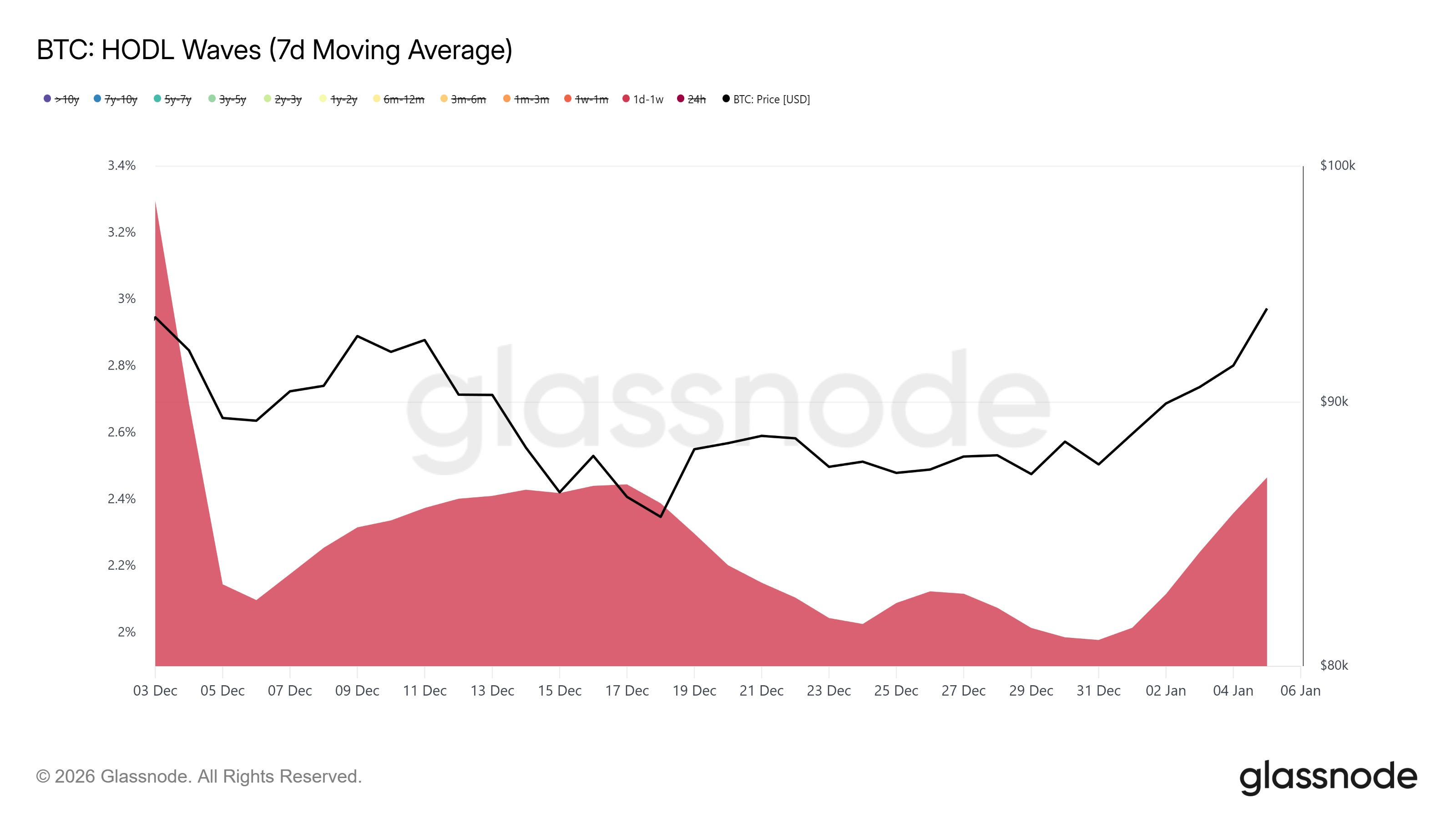

Short-term holders are emerging as the dominant buyers in this phase. Addresses that acquired BTC within the past day to week have increased their share of the total supply. Over seven days, STH holdings rose from 1.97% to 2.46%.

This growth highlights fresh demand entering the market. New buyers are stepping in despite elevated BTC prices, suggesting confidence in near-term upside. Such participation often fuels momentum during breakout phases rather than signaling late-cycle behavior.

STH-driven rallies can be volatile but effective when supported by broader accumulation. Combined with ETF inflows and exchange outflows, this demand structure points toward strength rather than fragility. Momentum remains aligned across multiple investor cohorts.

SponsoredBTC Price Aims At Two-Month High

Bitcoin trades near $93,329 at the time of writing, continuing its breakout move over the past three days. The recent escape from a descending wedge pattern carries a projected upside of approximately 12.9%. This technical target places BTC near $101,787.

While that level remains distant, current conditions support incremental advances. Strong buying pressure could push Bitcoin above $95,000. Flipping that level into support would likely open a path toward $98,000 and higher within days, reinforcing the breakout structure.

Risk remains if investor behavior shifts as price climbs. Selling pressure near $95,000 could interrupt momentum. A reversal may pull BTC toward the $91,511 support. Losing that level would invalidate the bullish thesis and reintroduce consolidation risk.